.Is Dollar General the Perfect Addition to a Dividend Stock Portfolio?

Shares of Dollar General (NYSE: DG) are currently down 72% from their all-time high, the biggest reduction since the company went public again in 2009. It’s a far from perfect company, as I’ll explain. But this incredible drop in the stock price makes it a compelling addition to a dividend stock portfolio.

According to GuruFocus, the dividend yield for the S&P 500 dropped below 2% in 2020, and has continue to fall to its current 1.2% yield. This means that for every $1,000 invested, you get just $12 in annual dividend income. This is about the lowest it’s ever been for the index.

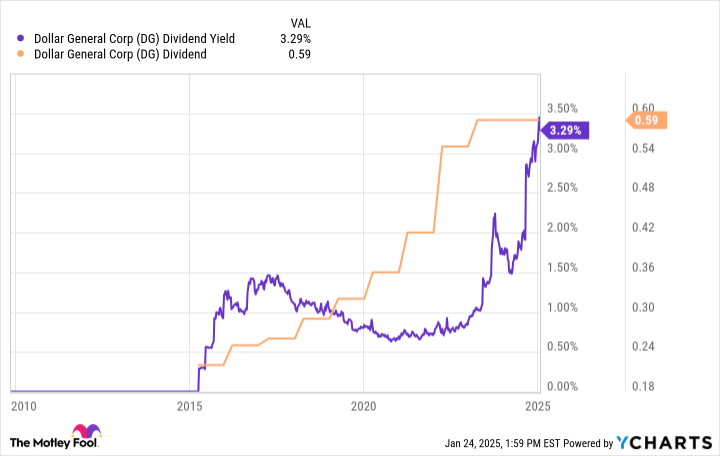

But for Dollar General, the dividend yield has never been higher; that’s thanks to the steep drop in the share price. As of this writing, the yield is currently 3.3% — nearly triple the average for the S&P 500.

Source: FINANCE.YAHOO