The foreign exchange market, known as forex (FX), is a decentralized marketplace facilitating the exchange of various currencies. This occurs over the counter (OTC) through the interbank market, rather than on a centralized exchange. You’ve likely engaged in the forex market unknowingly, perhaps by purchasing imported goods or exchanging currency while traveling abroad. Traders are attracted to forex for several reasons, including:

- The expansive size of the FX market

- A diverse range of tradable currencies

- Varied levels of volatility

- Low transaction costs

- Availability of 24-hour trading throughout the week

This article is beneficial for traders at all experience levels, whether you’re new to forex trading or seeking to enhance your existing knowledge. Its aim is to establish a solid understanding of the foreign exchange market.

EXPLAINING THE FOREX MARKET

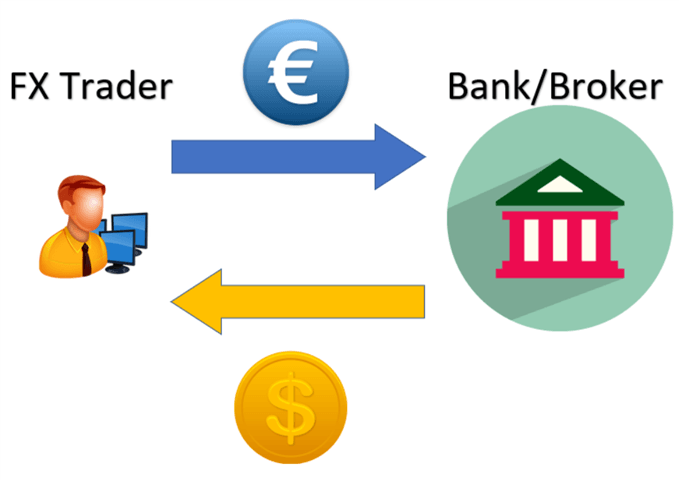

In simple terms, the foreign exchange market operates like most other markets, being influenced by the principles of supply and demand. To illustrate, when there is high demand for the US Dollar from European citizens holding Euros, they convert their Euros into Dollars. Consequently, the value of the US Dollar increases while the value of the Euro decreases. It’s important to note that this exchange impacts only the EUR/USD currency pair and does not, for instance, cause the USD to depreciate against the Japanese Yen.

What Drives Forex Market Movements?

In reality, the aforementioned example represents just one of many factors that can influence the FX market. Other factors include significant macroeconomic events such as the election of a new president, or country-specific indicators like prevailing interest rates, GDP, unemployment, inflation, and debt-to-GDP ratio, among others. Successful traders utilize an economic calendar to remain informed about these and other crucial economic announcements that can drive market movements.

Why is Forex so Appealing?

The foreign exchange market enables participation from large institutions, governments, retail traders, and private individuals, facilitating currency exchange through the interbank market (between banks). One of the key advantages of forex trading between global banks is its accessibility around the clock throughout the week. As the Asian trading session concludes, European and UK banks become active before passing the baton to the US session. The trading day reaches its conclusion as the US session transitions into the Asian session for the following day. Adding to its appeal, this market is the most liquid in the world, with an average daily trading volume of $5.1 trillion as per the BIS Triennial Survey 2016. This high liquidity ensures that traders can easily enter and exit positions, given the abundance of willing buyers and sellers in the foreign exchange market.

Who Engages in Forex Trading?

Forex trading primarily attracts two categories of participants: hedgers and speculators. Hedgers aim to mitigate the impact of significant fluctuations in exchange rates. Consider large corporations like Exxon, which seek to minimize their vulnerability to movements in foreign currencies. Conversely, speculators are inclined towards risk-taking and actively seek out volatility in exchange rates to capitalize on. This group encompasses the trading desks at major banks as well as retail traders.

Understanding a Forex Quote

All traders must grasp the mechanics of reading a forex quote, as this determines the entry and exit points for trades. Examining the currency quote below, the first currency listed in the EUR/USD pair is referred to as the base currency, which in this case is the Euro. Meanwhile, the second currency in the pair (USD) is termed the quote or variable currency.

WHAT IS FOREX TRADING AND HOW DOES IT OPERATE?

Numerous individuals ponder about profiting from forex trading. Luckily, the fundamentals of forex trading are relatively simple. If you anticipate that a currency’s value will increase (appreciate), you purchase the currency, a strategy referred to as going “long”. Conversely, if you anticipate that the currency will decrease in value (depreciate), you sell that currency, known as going “short”.

WHY ENGAGE IN FOREX TRADING?

Forex trading offers numerous advantages over other markets, outlined below:

1. Low transaction costs: Typically, forex brokers profit from the spread, provided the trade is executed and closed before any overnight funding charges apply. Thus, forex trading is cost-efficient compared to markets like equities, which entail commission charges.

2. Narrow spreads: Bid/Ask spreads are minimal for major FX pairs owing to their high liquidity. The spread represents the initial obstacle to overcome when trading; any additional pips moving in your favor translate directly into profit.

3. Abundance of profit opportunities: Forex trading enables traders to speculate on both appreciating and depreciating currencies, offering a wide array of currency pairs for identifying lucrative trades.

4. Leverage utilization: Forex trading involves leverage, allowing traders to invest only a fraction of the total trade cost. While this can amplify profits, it also heightens potential losses. At HolyGrail Capital, we advocate for a disciplined approach to risk management, advising traders to limit effective leverage to 10 to one or less.

ESSENTIAL FOREX TRADING TERMINOLOGY TO REMEMBER

Base currency: This denotes the first currency listed in a currency pair. For instance, in EUR/USD, the Euro is the base currency.

Variable/quote currency: This signifies the second currency in the currency pair quotation, such as the US Dollar in the EUR/USD example.

Bid: The bid price indicates the highest price a buyer is willing to pay. When selling a forex pair, this price is observed, usually displayed on the left side of the quote and often in red.

Ask: Conversely, the ask price represents the lowest price a seller is willing to accept. When purchasing a currency pair, this price is observed, typically displayed on the right side of the quote and often in blue.

Spread: The spread refers to the difference between the bid and ask prices, representing the actual spread in the underlying forex market plus any additional spread imposed by the broker.

Pips/points: A pip or point denotes a one-digit movement in the fourth decimal place. Traders commonly use this term to describe currency pair movements, for example, stating that GBP/USD rallied 100 points today.

Leverage: Leverage enables traders to initiate positions while investing only a fraction of the total trade value. This permits traders to control larger positions with minimal capital. However, leverage magnifies both gains and losses.

Margin: Margin signifies the funds required to open a leveraged position, calculated as the difference between the full position value and the funds lent by the broker.

Margin call: A margin call occurs when the total deposited capital, adjusted for profits or losses, falls below a specified threshold (margin requirement).

Liquidity: A currency pair is deemed liquid if it can be readily bought and sold, owing to the participation of numerous traders in trading the currency pair.